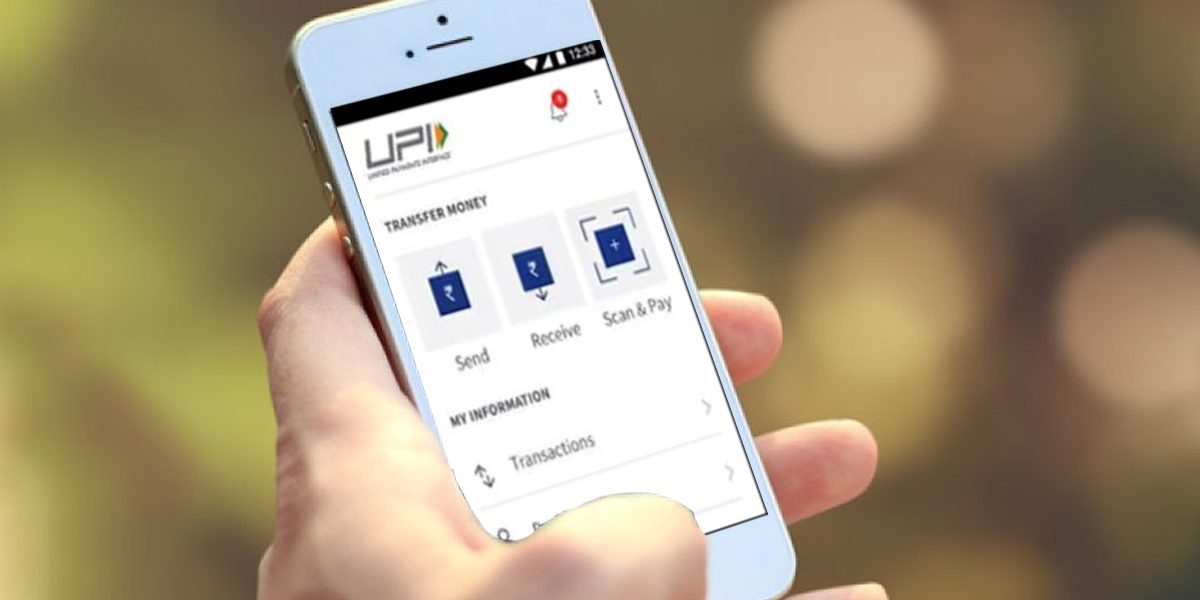

India is rapidly moving towards digital payments. RBI and National Payment Corporation of India (NPCI) are easing rules to ease the way for digital payments.

For which Aadhaar based UPI payment service has been allowed. After the relaxation from RBI and NPCI, PhonePe has started a new Aadhaar based OTP service, through which UPI can be activated.

PhonePe becomes the first Aadhaar based UPI

PhonePe claims that it is the world’s first platform with Aadhaar based UPI service. The company claims that after the Aadhaar based UPI service, the number of new users making online payments will increase. Let us tell you that till now Debit card was required to use UPI service. But after Aadhaar based authentication, the hassle of Debit card will be over.

It is worth noting that a large population of the country does not have a debit card, who are not able to use the UPI service. Aadhaar based UPI service can prove to be very beneficial for such people.

How customers will benefit

In the current model of UPI, a Debit Card is required for the UPI PIN during the UPI registration process for each and every user. But as it is known that there are a large number of bank account holders who do not have debit cards. For these, Aadhaar based e-KYC can be done through the new service of PhonePe.

For this, you have to enter the 6 digit number of Aadhaar on the PhonePe App. After this you will receive OTP from UIDAI. After this your bank will complete the authentication process. After this, users will be able to do all the services of UPI payment such as payment check and bank balance check.