The last date for filing Income Tax Return (ITR) is 31 July. Income tax payers should fill their ITR very carefully. All the necessary documents should be collected before filing ITR.

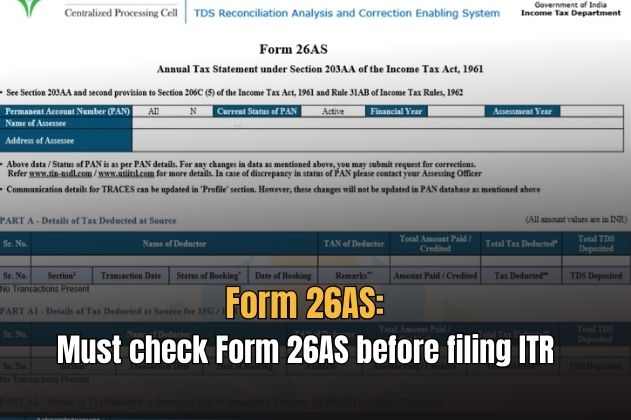

Along with this, they should also be checked thoroughly and if any wrong information is entered in them, get it corrected. Form 26AS is also one of the important documents that should be checked before filing Income Tax Return (ITR). It is necessary to match Form 26AS with Form 16/16A before filing ITR. Before filing ITR, make sure that the amount deducted as TDS is included in Form 26AS or not. This form can be downloaded from the e-filing website of the Income Tax Department.

Form 26AS itself tells whether the TDS deducted has been deposited with the government or not. Form 26AS is a consolidated tax statement. It contains the details of tax deducted from different sources of income of the taxpayer.

These include details like tax deduction at source (TDS), tax collection at source (TCS), payment of advance tax or self-assessment tax, regular tax, refund. Whereas, in Form 16, there is complete information about the tax deducted from the salary. Form 16A contains information about TDS deducted on income other than salary. Form 16 is given by the company to the employee.

Therefore it is important to check that

Form 26AS contains information about the TDS amount deducted from your income in a financial year and depositing it with the government. The company deposits the deducted amount with the government along with your PAN number. Apart from salary, Form 26AS also contains information about TDS deducted on interest by the bank and advance tax deposited by you.

Many times it happens that the information given in Form 26AS is also wrong. It is possible that the information given in Form 16 does not match with the information given in Form 26AS. While filing ITR with wrong information can cause you loss of money, there is also a risk of cancellation of your ITR.

If the information is wrong then it is very important to rectify it. If your company or bank has made a mistake in depositing tax with the government with your PAN number, then you will have to go to your company or bank to deduct the tax. You have to ask the company or bank to revise the TDS return. Once you file your TDS return with the correct details, your Form 26AS will reflect the correct information.