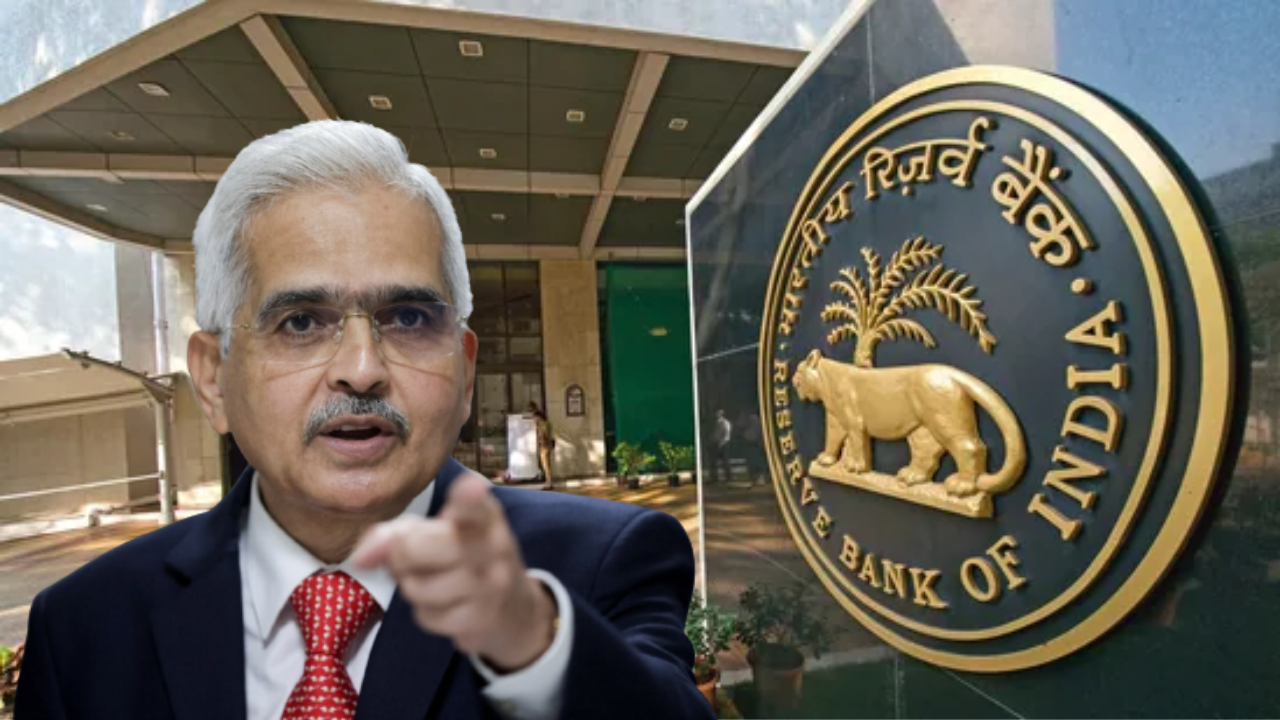

The Reserve Bank has taken a big decision today, expanding the scope of the UPI payment system. RBI Governor Shaktikanta Das said that now overdraft facility can also be used for UPI payment. This means, if an account holder has got overdraft facility then he can use this credit line for UPI payment. Please tell that this facility is not available with every bank account. However, limited customers definitely get this facility from every bank.

UPI dominates digital transactions

The Reserve Bank is constantly working on plans to expand the UPI payment ecosystem. UPI dominates digital retail transactions and 75% of transactions are done with its help. Till now UPI is mainly used with the help of deposit accounts. Transactions can be done with the help of UPI only if there is money in your account. After the latest order of the Reserve Bank, if credit line ie overdraft facility is available with an account, then UPI transactions can be done with this amount also.

UPI linked to wallet in some cases

Announcing the monetary policy, Governor Das said that it is related to the already approved loan. At present, apart from deposit accounts, UPI transactions are also done with the help of WALLET and prepaid cards in some cases. Governor Das said that RBI will issue detailed instructions in this regard very soon.

Acceptance of digital banking will accelerate

In this regard, Indian Banks’ Association (IBA) President AK Goyal said that the purpose of expanding the scope of UPI by including pre-sanctioned credit lines in banks is to increase access to institutional credit.

Anand Kumar Bajaj, Founder and CEO of PayNearby, said that the decision to expand the scope of UPI by allowing pre-approved credit lines in banks through UPI is a positive step. With this, it will be easier for the customers to access the facility of getting loans. This will accelerate the acceptance of digital banking in the country.