The Reserve Bank of India (RBI) said that banks can open/close rupee accounts (non-interest bearing) in the name of their overseas branches or correspondents without informing the central bank.

However, in a ‘master’ direction issued on deposits and accounts, the RBI said that opening rupee accounts in the name of branches of Pakistani banks operating outside Pakistan will require special approval of the Reserve Bank. It said that deposit in an account of a non-resident bank is an approved mode of payment to non-residents and, therefore, is subject to the rules applicable to transfer in foreign currency.

RBI said that withdrawal from a non-resident bank account is actually a remittance of foreign currency. On funding of non-resident bank accounts, RBI said that banks may freely purchase foreign currency from their overseas correspondents/branches at current market rates for holding funds in their accounts to meet their actual needs in India.

However, transactions in the accounts should be strictly monitored to ensure that foreign banks do not adopt a speculative approach to the Indian rupee. Any such cases should be reported to the Reserve Bank.

Earlier, the Reserve Bank of India had said something important about strengthening the banking system of the country. RBI said that a buffer capital i.e. CCYB has been maintained to deal with emergency situations and difficulties. However, it will be used according to the circumstances.

RBI said on Tuesday that the ‘countercyclical’ capital buffer (CCyB) designed to deal with recessionary situations will not be used at present as we believe that it is not needed in the current situation.

Related Articles:_

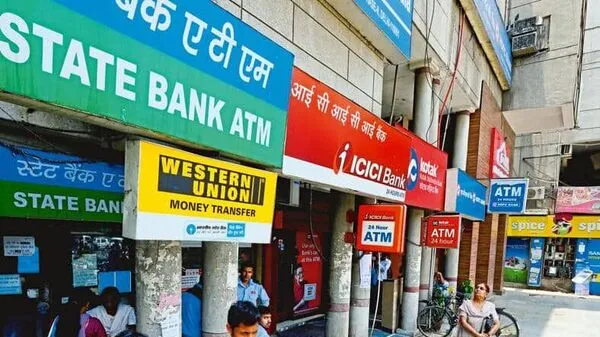

ICICI Bank cuts interest rates on FD and savings accounts, read full details

Weather Update: Heavy rains with strong storms again tomorrow, IMD issues alert

PPF: Can you open more than one PPF account? Know what the rules say