PF money withdrawal: You can also withdraw your PF money from UMANG app. The app can be downloaded from both iOS and Android. The way to withdraw PF money is very easy.

In earlier times, withdrawing money from EPF was a difficult task, but now you can withdraw EPF money sitting at home. For this you have to download UMANG app. Through this you can easily withdraw PF money. The government launched the UMANG app in 2017. Let us tell you how you can withdraw your money from UMANG app.

Make a claim for money like this through Umang App

- First of all login to UMANG App

- Select EPFO and click on ‘Employee Centric Services’.

- After this you click on ‘Raise Claim’ option.

- Enter UAN details.

- Click on ‘Get OTP’

- After this an OTP will come on the registered mobile number.

- After filling the OTP, click on ‘Login’.

- After this, now enter the last four digits of the bank account.

- Select the Member ID and click on ‘Proceed for claim’.

- After that enter ‘Address.

- After entering the address, click on ‘Next’. After that upload the photo of the check.

- After this the money will be transferred to your account within the stipulated time frame.

Through this app you can easily check PF details, apart from this you can also download passbook.

How to download

UMANG App can be downloaded from Google Play Store (Android users) and iOS App Store (iPhone users). Apart from this, you can also download this app by giving a missed call to 9718397183, in fact, on missed call, you get a link, from which you can easily download it.

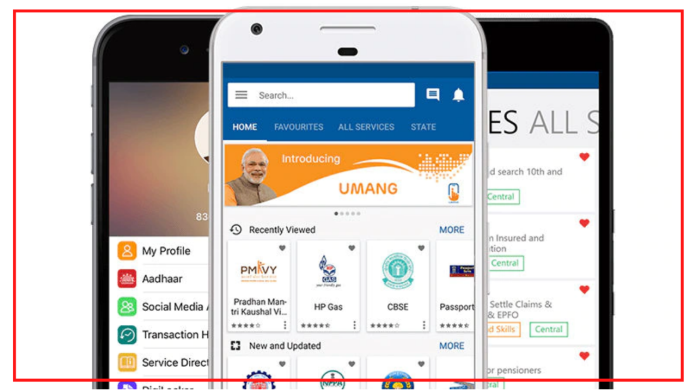

What is UMANG App

The Government of India launched this app in 2017. This app was created by the Ministry of Electronics and Information Technology. You can download the app from both iOS and Android. This app provides a wide range of services. Through this app you can avail facilities like Employees Provident Fund (EPF), PAN, Aadhaar, DigiLocker, Gas Booking, Mobile and Electricity Bill Payment etc. Most of the employees working in government and non-government sectors have a PF account. While doing the job, some part of the salary of the employees is credited in their PF account.