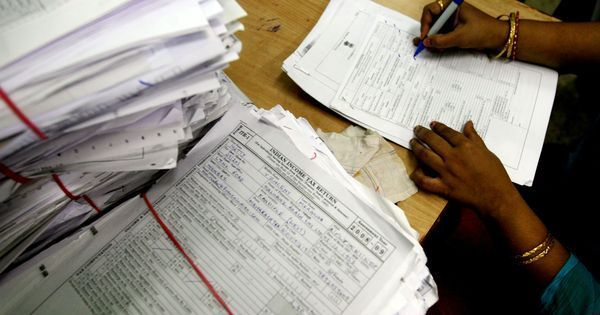

The month of May has started and it is the right time to file Income Tax Return (ITR). The last date for filing ITR for the financial year 2022-23 is 31 July. At the same time, it is very important to pre-validate your bank account before starting the process of ITR filing.

Explain that if a refund is made after filing ITR, then the Centralized Processing Center (CPC) of the Income Tax Department transfers it to your bank account. However, for this it is necessary to pre-validate the bank account in which you want to transfer the refund.

Bank account pre-validation is an important step in ITR filing, the main objective of which is to ensure the identity and security of the user’s account. In the pre-validation process, the ITR portal or software system validates your bank account details with valid parameters. This validation ensures that your account is valid and your identity is correct.

Important things for taxpayers before pre-validation

>> He should have a valid PAN which is linked to his bank account.

>> PAN should also be linked to the e-filing facility of the IT department.

>> Taxpayers should register themselves on the e-filing portal.

>> One should have a valid bank account number and a valid IFSC code of their home branch.

Steps to pre-validate your bank account

- Go to the official website of IT department incometax.gov.in.

- Use your login details or PAN/Aadhaar details to login.

- After logging in, go to the ‘My Profile’ section and select ‘My Bank Account’.

- As soon as you click on it, the option of ‘Add Bank Account’ will appear.

- Enter the required information like name, bank account number, type, IFSC code, bank name etc.

- Click on ‘Validate’ option and submit.