New PF withdrawal Rule: If you are PF account holders then there is a good news for you. Now you will get relief in TDS on withdrawal of PF balance. In fact, in the Union Budget 2023, the Finance Minister has announced a change in the rules for withdrawal of Provident Fund (Provident Fund or PF) from the Employees’ Provident Fund (EPF).

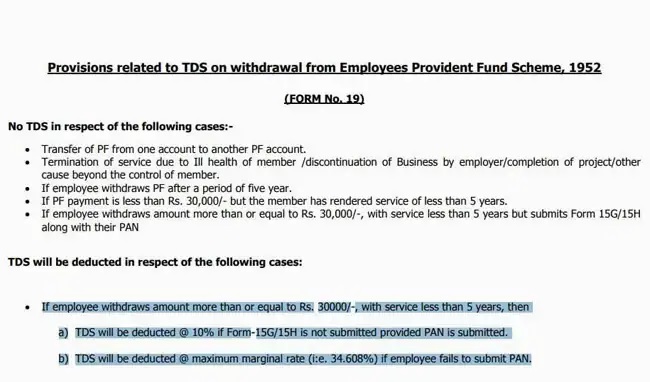

Under which now if for some reason you want to withdraw your PF balance before a period of 5 years and your PAN card is not linked, then in such a situation now you will have to pay 20% TDS instead of 30%. These new rules will come into force from 1 April 2023. However, these rules will be applicable in case of non linked PAN card.

Less TDS will have to be paid than earlier

Investing in Employees Provident Fund (EPF) is considered a better option for any employed person. A part of the salary of the salaried class people is deposited in their EPF account. On which the government gives strong interest. PF balance helps people in any kind of financial crisis in future.

Many times in times of need or difficulty, we need to withdraw PF balance before 5 years. At such times the account holders have to pay TDS. During this, account holders whose PF account is not linked to their PAN card will have to pay less TDS than before. Due to which they will get a big relief, earlier they had to pay 30% TDS on such withdrawals, which has now been announced to be reduced to 20%.

If it has not been five years since the PF account was opened, and the amount is withdrawn, and the PF account is linked to the PAN card, then TDS will not be deducted on it, but the withdrawn amount will be included in the taxable income, and that But income tax will also have to be paid.

For this, you have to send a message to this number 7738299899 from your registered mobile number with EPFO. You have to enter ‘EPFOHO UAN’ i.e. first EPFOHO and then UAN. This facility is available in 10 languages - English, Hindi, Punjabi, Tamil, Malayalam, Gujarati, Marathi, Kannada, Telugu and Bengali. If you want SMS in a language other than English, add its first three letters after the UAN ID. For example, if you want a message in Hindi, then you have to write ‘EPFOHO UAN HIN’.

Check balance by missed call (How to check PF Balance via missed call)

PF account holders can also know their PF balance through missed call. For this, you have to make a missed call on 9966044425 from your registered mobile number. After this, a message related to the amount of the account will come on your mobile number.