ITR Filing 2022: As the deadline for filing income tax returns is getting closer, the campaign to extend the date on social media platforms has intensified.

The last date for filing income tax return is 31st July, that is, those who have not yet filed income tax return, they have only 5 days left. As the last date for filing income tax returns is nearing, the exercise to extend this date has intensified on social media. At this time ‘Extend Due Date Immediately’ is trending fiercely on the social media platform Twitter. Till writing the news with this hashtag, more than 14 thousand tweets have been done on Twitter. Let us tell you that last year also such a campaign was run on social media.

Demand for extension of deadline intensified

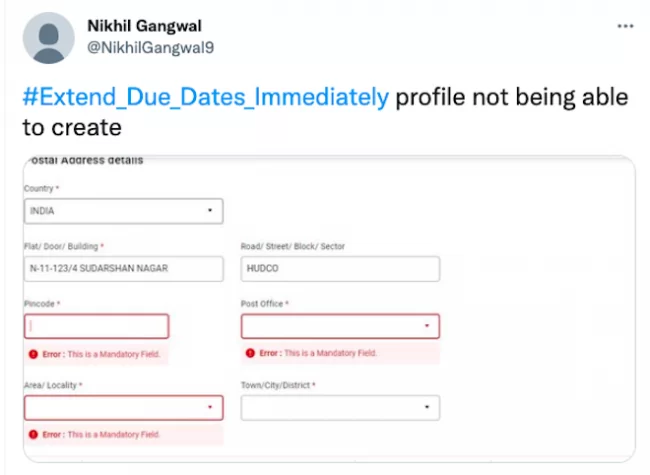

Let us know that at this time the hashtag ‘Extend Due Date Immediately’ is trending on Twitter. Using this hashtag, users are telling their problems and are requesting Finance Minister Nirmala Sitharaman for help.

Some users have shared this by taking a screenshot of the ITR portal and have written that the portal is down again. Apart from this, other users are appealing to increase the last date along with other problems.

There will be a penalty for filing returns after July 31

The last date for filing income tax return is July 31. Although ITR can be filed even after July 31, taxpayers may have to pay a penalty for doing so. Talking about the amount of fine, if someone’s income is more than 5 lakhs per annum, then he will have to pay a fine of Rs 5000, apart from this, if the income is less than 5 lakhs per annum, then he will have to pay a fine of 1000 rupees.

More than 3 crore ITR files

In a tweet from the department, it has been said that more than 3 crore ITRs have been filed till July 25, 2022 for the assessment year 2022-23. The last date fixed by the Income Tax Department is 31 July 2022. This data is only till 25 July.