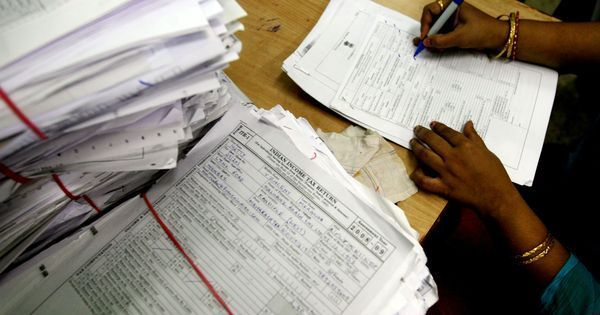

ITR Filing Latest Update: The last date to file ITR for the financial year 2022 23 has passed. According to the Income Tax Department, 5 crore 82 lakh 88 thousand 962 people have filed ITR for 2022 23. According to the Income Tax Department, 67,97,067 people filed ITR till 11 pm on July 31. But, if you have not been able to file ITR due to any reason, then there is some provision for this, through which you will be able to file ITR now.

How much will the penalty be after the deadline?

The Income Tax Department had set July 31 as the deadline for filing ITR. If you have not been able to file your ITR by 31st July 2022, then you will now have to pay a penalty for that. Yes, according to the rules of the Income Tax Department, you will have to pay a fine of Rs 1000 on income 5 lakh or less. At the same time, if your income is more than 5 lakhs, then you will have to pay 5000 fine.

If ITR is not filed soon then double penalty will be imposed

Apart from this, if you do not file your ITR before 31st December 2022 after the deadline, then the Income Tax Department will impose double penalty on you. This means if your fine is Rs 5,000, you will have to pay Rs 10,000. Only after this process will you be able to file your ITR. It is better that you file your ITR at the earliest by paying the least penalty.

What is the provision as per Income Tax Section 234F

According to Income Tax Section 234F, if you file ITR after the last date of filing return, you will have to pay Rs 5,000 as penalty. At the same time, if your total income does not exceed 5,00,000, then you can file your ITR by paying a penalty of 1000. Also, if a person’s total income does not exceed the basic exemption limit under the tax regime chosen by him, he will not have to pay any penalty while filing belated ITR.