As per the instructions of RBI, from Thursday, May 1, 2025, banks are implementing revised fees of ATM charges. With this move of the banks, withdrawing cash from ATM after the free limit will become expensive.

Let us tell you that on March 28, the Reserve Bank of India had approved the increase in charges after the free limit is over. According to the rules of the Reserve Bank of India, any customer can do 5 free transactions (including financial and non-financial) from his bank’s ATM in a month. From today, after the free transaction limit is over, you will now have to pay an extra charge of Rs 2 on each transaction. With the implementation of the new rules, after the free limit is over, a charge of Rs 23 will now be levied on each transaction.

The Reserve Bank of India issued the notification on March 28

According to the RBI notification dated March 28, 2025, “ATM interchange fee will be decided by the ATM network. After the free limit, a maximum fee of Rs 23 may be charged to the customer on each transaction. This will be effective from May 1, 2025. Applicable taxes, if any, will be payable separately. These instructions, with changes as required, will also apply to transactions done at cash recycler machines,” RBI had said.

You can make free transactions only 3 times in metro cities

According to the new rules, if you are using another bank’s ATM, you can do a maximum of 3 free transactions in a month in metro cities and a maximum of 5 free transactions in non-metro cities. If you are using your bank’s ATM, you can do 5 free transactions in a month. After crossing the limit of free transactions, you will have to pay a charge of Rs 23 on each transaction. Currently, after the free transaction limit is over, the bank can charge its customers a maximum of Rs 21 on each transaction. Let us tell you that this decision will cost those bank customers dearly, who withdraw cash or use any other service using ATM several times in a month.

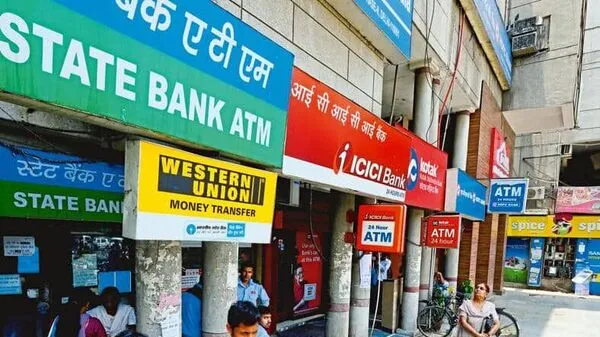

These banks have implemented new rules from today

Many banks including State Bank of India, HDFC Bank, Punjab National Bank and IndusInd Bank have implemented new rules for their customers from today. Banks said that after the free limit, Rs 23 + GST will have to be paid on each transaction. According to PNB, Rs 11 will have to be paid on non-financial transactions.

Related Articles:-

Pakistanis leave India deadline: Govt has extended the deadline for returns, what is the deadline

CBDT notifies ITR-1 Sahaj, ITR-4 Sugam for financial year 2024-25, All You Need To Know