PAN and PRAN benefits : PAN and PRAN may sound similar, but their functions are completely different. Both PAN and PRAN are necessary for financial purposes in their respective places.

Permanent Account Number (PAN) is a 10 digit unique number. Whereas, Permanent Retirement Account Number (PRAN) is a 12 digit unique number. PAN is mandatory for all taxpayers in India. PAN card issued by the Income Tax Department is necessary for all tax related work. Whereas, PRAN card is necessary for those investing in National Pension System (NPS).

What is PAN?

PAN or Permanent Account Number issued by the Income Tax Department is a 10 digit unique number which is alphanumeric. With the help of the number given to all taxpayers, the department manages and maintains records of all tax related transactions and information. PAN is mandatory for all taxpayers for income tax related work like filing ITR, claiming refund and filing revised returns.

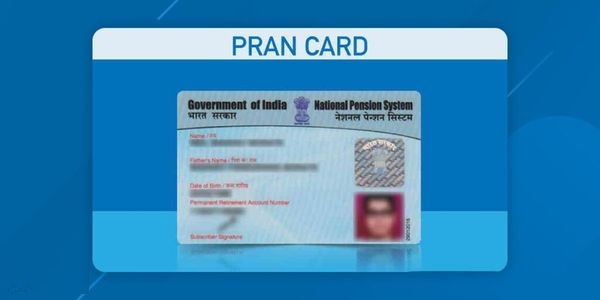

What is PRAN?

Permanent Retirement Account Number (PRAN) is a unique 12 digit number. It is issued by National Securities Depository Limited (NSDL). This is mandatory for all subscribers under the National Pension System (NPS). PRAN helps in tracking all transactions related to NPS investments and taking pension claims.

What is the difference between PAN and PRAN

P.R.A.N.

An individual can have two types of NPS accounts under PRAN which include Tier-I and Tier-II. PRAN works as an identity for all existing and new NPS subscribers, also helps them track their pension funds. Applications for PRAN can be submitted on the portal. A customer can have only one PRAN account.

Uses of PAN Card

PAN is used in all income tax, investment, saving, opening bank account, investing in share market etc. This is a valid KYC document. You will have to apply for PAN on NSDL or tax e-filing portal.