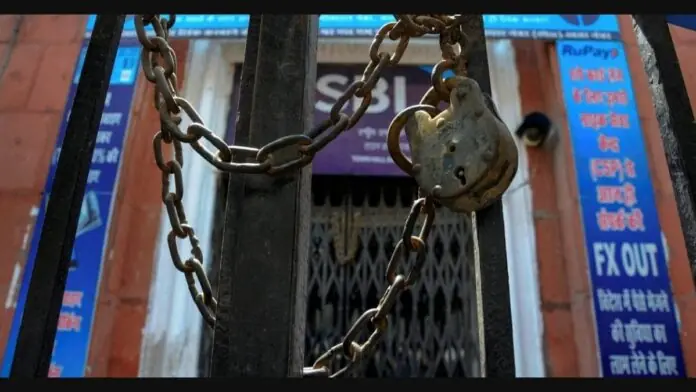

The United Forum of Bank Unions (UFBU), the apex body of nine major bank unions, has officially announced a nationwide strike on Tuesday, January 27, 2026. This industrial action, combined with a weekend and a national holiday, will effectively halt physical banking operations for three consecutive days across India.

Also Read | The 2026 Personal Finance Reset: Adapting to India’s New Labour Codes

1. The 3-Day Impact Timeline

Customers are advised to plan their transactions early, as branch-based services will be unavailable during this period.

| Date | Day | Reason for Closure |

| Jan 25, 2026 | Sunday | Weekly Holiday |

| Jan 26, 2026 | Monday | Republic Day (National Holiday) |

| Jan 27, 2026 | Tuesday | All-India Bank Strike |

Also Read | The 2026 Personal Finance Reset: Adapting to India’s New Labour Codes

2. Why Are Bank Employees Striking?

The primary demand is the immediate implementation of a 5-day work week.

-

The Agreement: In March 2024, the Indian Banks’ Association (IBA) and unions signed a wage revision agreement that included declaring all Saturdays as holidays.

-

The Delay: Unions allege the Central Government has been “sitting tight” on the recommendation for nearly two years without issuing the final notification.

-

The Trade-off: Employees have offered to work an extra 40 minutes daily (Monday to Friday) to ensure no loss of total working hours or productivity.

-

Precedent: Unions argue that the RBI, LIC, GIC, and stock exchanges already operate on a 5-day week, making the current banking schedule discriminatory.

Also Read | The 2026 Personal Finance Reset: Adapting to India’s New Labour Codes

3. Which Services Will Be Affected?

While physical branches will be closed or heavily disrupted, digital infrastructure is expected to remain mostly functional.

-

❌ Affected Services: Cheque clearing, cash deposits/withdrawals at counters, Demand Draft (DD) issuance, and loan processing.

-

✅ Functional Services: UPI (GPay, PhonePe, etc.), Mobile Banking, Net Banking, and IMPS/NEFT/RTGS transfers.

-

⚠️ Partial Impact: ATMs may run out of cash by the third day (Jan 27) as cash-loading agencies often face logistical hurdles during strikes.

4. Participation of Private Banks

The strike will see near-total participation in Public Sector Banks (PSBs) and Old-Generation Private Banks (like Federal Bank, Dhanlaxmi Bank, etc.). New-generation private lenders (HDFC, ICICI, Axis) typically remain operational, though their cheque-clearing processes may be delayed due to the disruption of the central clearing house….![]()

Also Read | The 2026 Personal Finance Reset: Adapting to India’s New Labour Codes