Now you will be able to deposit money in Atal Pension Yojana and National Pension System (NPS) through UPI also. UPI i.e. Unified Payment Interface allows you to deposit money in real time. Therefore, you will not have to take the tension of depositing money in NPS or Atal Pension Scheme and knowing the status. The Pension Fund Regulatory and Development Authority, which runs both these schemes, has started a UPI handle for depositing money.

With the help of de-remit from this UPI handle, money can be deposited in NPS and Atal Pension Yojana (APY). Till now, money could be deposited in NPS and APY schemes only through net banking. In net banking, money was deposited with the help of IMPS, NEFT or RTGS. Now a new facility of UPI has been added to it. With the help of this, customers will be able to deposit money in the account in real time and they will also know the status immediately.

As per PFRDA, the UPI handle for de-remit has been introduced whose address is PFRDA.15digitVirtualAccount@axisbank. PFRDA has told that if money is deposited through UPI before 9.30 am, it will be counted in the payment of the same day. If money is deposited in NPS or APY after 9.30 am, then it will be considered as investment for the next day.

PFRDA runs two types of pension schemes. This includes the National Pension System i.e. NPS and Atal Pension Yojana. NPS is for those working in the organized sector while employees of the non-organized sector can also take advantage of APY. NPS was started in 2003. Central employees who have been joining since January 1, 2004, they are required to join NPS. Armed forces have been kept out of this. In May 2009, private sector employees and people working in the unorganized sector were included in the NPS.

To deposit money in NPS and APY, you have to create a virtual account first. Only after that money can be deposited through UPI.

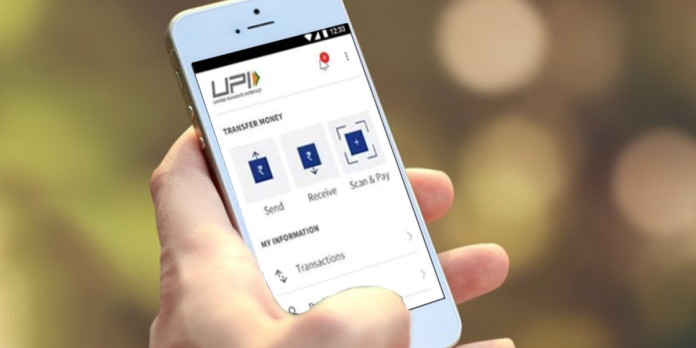

How to deposit money with UPI

- Visit the Central Recordkeeping Agency (CRA) system and log on to the ENPS website

- Fill the details to verify the Permanent Retirement Account Number (PRAN)

- Enter the OTP received on the mobile and select the account (Tier 1 or II) for which the virtual account is to be created

- Further, select the option ‘Generate Virtual Account’. An acknowledgment number will appear

- Enter the 15-digit VAN in the UPI handle. Then type ‘PFRDA.15digitVirtualAccount@axisbank’ to make payment

- Now enter the amount you want to deposit, make the payment