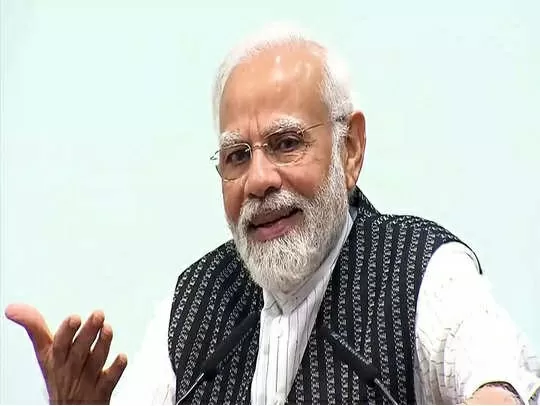

Sukanya Samriddhi Yojana: The Central Government has started many schemes for the future of daughters. There is also a Sukanya Samriddhi Yojana in it. Which was started by the Modi government in the year 2015.

In this scheme, you can make your daughter a mistress of Rs 65 lakh by saving just Rs 416 every day. This is a long term plan. If you also want to invest for your daughter’s marriage or higher education, then investing in Sukanya Samriddhi Yojana (SSY) can prove to be better for you.

The special thing about this scheme is that investment in it can be started from Rs.250. Interest is also better in this than other schemes. Along with this, the benefit of tax exemption is also available. By investing in this scheme, you can be free from the tension of your daughter’s future. Through this scheme, you can make a thick fund.

You can deposit up to Rs 1.5 lakh annually

An account can be opened for a girl child up to 10 years of age in Sukanya Samriddhi Yojana. In this, you can deposit a minimum of Rs 250 and a maximum of Rs 1.50 lakh. The scheme will mature when the daughter turns 21. However, your investment in this scheme will be locked in at least till the girl child turns 18. Even after 18 years, 50% of the total money can be withdrawn. Which she can use for graduation or further studies. After this, all the money can be withdrawn only when she is 21 years old.

Money will be deposited for 15 years

The specialty of this scheme is that you do not have to deposit money for the entire 21 years. Money can be deposited only for 15 years from the time the account is opened. While the daughter will continue to get interest till the age of 21 years. At present, the government is paying interest on this at the rate of 7.6 per cent per annum.

Where to open account?

Sukanya Samriddhi Yojana (SSY) account can be opened in any post office or bank. Under the scheme, within 10 years of the birth of a girl child, you can open this account by depositing at least Rs 250.

High return scheme

The interest rate in Sukanya Samriddhi Yojana is 7.6 per cent per annum. SSY is getting interest as compared to PPF, FD, NSC, RD, Monthly Income Scheme or Time Deposit. The special thing is that the maturity of the scheme is 21 years, but the parents have to invest only 15 years in it. Interest keeps on compounding for the rest of the year. The amount you will invest in this scheme. You will get 3 times the return on maturity. At the current interest rates, a maximum amount of up to Rs 64 lakh can be raised through this scheme.