Income Tax Slab Change: Every year people in India are curious about what the government will do for them in the Union Budget. Budget 2023 (Budget 2022) will be the last full budget of the central government.

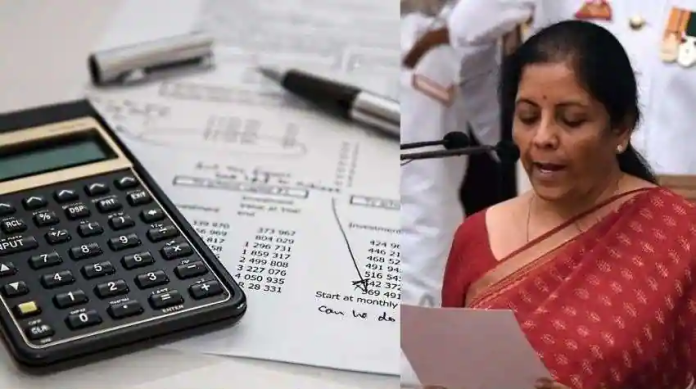

Therefore, this time it is expected that Finance Minister Nirmala Sitharaman will give many gifts to the people this time. If sources are to be believed, there is a possibility of change in the current income tax slab in this year’s budget. Income tax payers also hope that in the budget, the government will try to woo the middle class by increasing the income tax limit.

Even in the last budget, it was expected that the government would give tax relief to the middle class. But, this was not done. Reviewing Budget 2022, TV Mohandas Pai, chairman of Aerin Capital Partners and renowned financial expert, said that Finance Minister Nirmala Sitharaman has turned the budget into a ‘transformational budget’ by not giving tax relief to the middle class. It is expected that this time the Finance Minister will not let this opportunity pass.

If the income tax limit is increased by changing the income tax slab, then the middle class will be benefited the most. The middle class faced the biggest problem in Kovid-19. Most of the jobs in this category went during the Corona period. This class also spent the most on health.

Now the Indian economy has recovered to a great extent from the effect of Corona. The income of the government is increasing. This has raised hopes that this time the government will definitely give tax relief.

In March 2022, Finance Minister Nirmala Sitharaman had told that a total of 8,13,22,263 people have filed income tax in the assessment year 2020-21 i.e. 2019-20 financial year. If we consider only four members in the family of an income tax payer, then there are 32 crore people, whom we can call middle class.

The middle class is the engine of consumption in the Indian economy. This is the population that buys cars and takes home loans. They are the main taxpayers of India and also the consumers.

Experts say that if the government increases the income tax limit by changing the income tax slab in the budget, then more money will come in the hands of the middle class of the country. This will also increase consumption. This will not only benefit the country’s economy, but BJP can also get political advantage in the general elections to be held in the year 2024.