Income Tax Slab Rate Change Expectations: After the Corona epidemic, the country’s economy is slowly coming back on track. Less than 60 days are left for the presentation of the Union Budget.

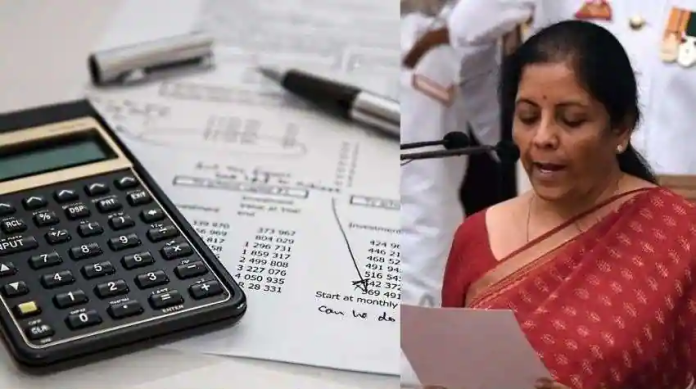

In such a situation, like every time, there are a lot of expectations from farmers to job professionals and businessmen regarding the budget. In this budget, tax experts are hoping that there can be some relief in the higher tax slab from Finance Minister Nirmala Sitharaman. If this relief is given by the government, then it will be the biggest announcement for the job profession.

Payment of tax on the basis of income slab

Deloitte is hopeful that in this budget, relief can be given by the government in the tax slab. At present, people have to pay income tax on the basis of income slab. Deloitte’s partner Tapati Ghosh says on the expectation from the budget that currently the highest income tax rate in the country is 42.744 percent (including surcharge and cess) on income above Rs 5 crore. There has not been any change in the income tax slab since the financial year 2017-18.

There will be a direct impact on the purchasing power, says Tapati Ghosh, this time it is expected that the government can give some relief to the tax payers coming in the 30% slab. This will directly affect their purchasing power. He hoped that this time the highest rate of income tax of 30 percent can be reduced to 25 percent. Along with this, the tax expert has also demanded that the limit of the highest tax rate of income tax should be increased from 10 lakhs to 20 lakhs.

Demand for revision of tax slab rates in Budget 2023 by Deloitte

– Currently there is 30 percent tax on income above Rs 20 lakh, which should be reduced to 25 percent.

– Tax on income between Rs 10 lakh and Rs 20 lakh should be reduced from 30 per cent to 20 per cent.

In the new tax regime, income tax should be reduced to 20 percent on income between 10 lakh to 20 lakh.