ITR Filing News: The Income Tax Department issues a total of 7 types of form issues. Out of this, only 4 forms are for individual income tax payers.

If you have filled any wrong form then you can get notice from Income Tax Officer. The last date for filing ITR for the year 2022-23 under review is 31 July 2022. You can be fined for filing tax returns after this date. By the way, usually the income tax payers know which ITR form they have to fill, but many times if a wrong form is filed accidentally or unknowingly, then what should be done in such a situation.

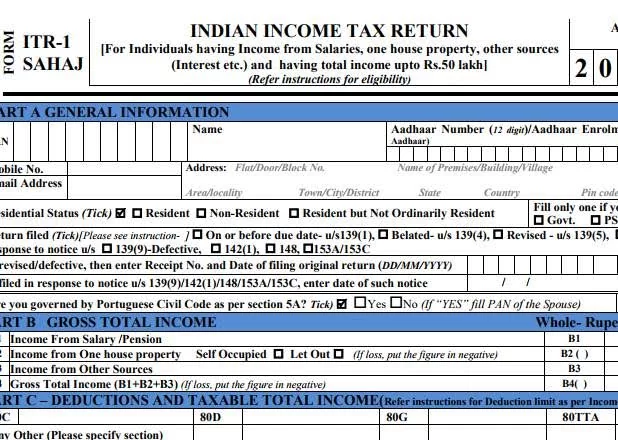

Income Tax Department issues a total of 7 ITR forms. Of these, ITR-1, 2, 3 and 4 are for individual taxpayers only. If the income tax payer fills the wrong form then he may face problems. Income Tax The Income Tax Officer can declare your return as defective under section 139(9) of the Act.

What happens after ITR is declared defective?

If the Income Tax Officer declares your return defective, he can send you a notice. You have to file the revised return through the correct form within 15 days from the date of receipt of the notice. If you fail to do so, then your ITR will be considered invalid and you will have to pay a penalty for filing the return after that.

4 types of forms

If your total income in the last financial year is Rs 50 lakh, then you have to fill ITR-1 form. This income can be received from other sources including your salary, interest from bank deposits and pension. After this there is ITR Form-2. The details of capital gains, foreign income, income from property or income earned on becoming a director of the company have to be given in this form. Form-3 is for those people who not only get income from the methods mentioned in Form-2, but also get income from any other business and profession. ITR-4 form is for Individuals, HUF and Firms having income up to Rs 50 lakh. Apart from this, they also get income from other business and profession.

What are the other 3 forms

ITR-5 is for partnership companies, business trusts, investment funds. At the same time, ITR-6 is for those companies which are registered under section 11. The IT-7 form is for organizations such as charitable trusts, political parties, research organizations or news agencies.