ITR Refund Status: This year the last date for filing income tax return for the financial year 2021-22 was 31 July 2022. Like the last two years, this year also the government did not extend the last date for filing returns. If you have filed your ITR return by 31st July 2022 and now you are just waiting for refund, here is how you can check refund status online.

How to check income tax refund status online

- First of all go to the website www.incometax.gov.in.

- Now log in to the account by entering your PAN number or Aadhaar number, user ID, user ID, user and password, date of birth and captcha code.

- After that click on My Account.

- Here you have to go to “Refund/Demand Status”.

- After this, you will see the details of assessment year, reason for refund failure and payment mode.

- After this you can see your refund status.

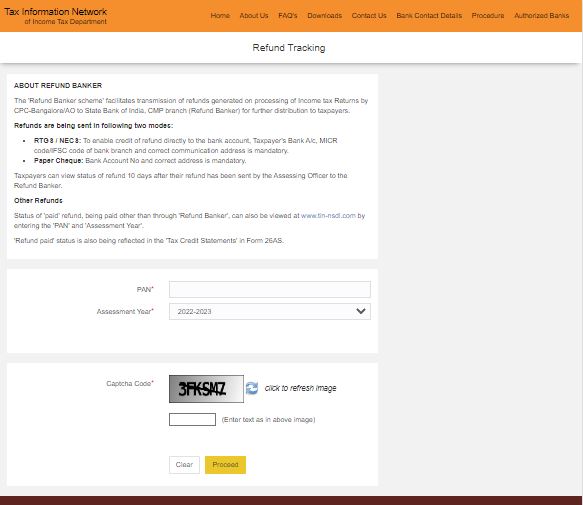

TIN can also check refund status from NSDL

- First of all go to https://tin.tin.nsdl.com/oltas/refundstatuslogin.html.

- Now you will see a window, below which you have to fill the PAN number and 3rd Step- After that enter the captcha code and proceed. After this you will be able to see your refund status.

Filing ITR after July 31 will attract penalty

If you have not filed your ITR by July 31 and want to file now, you may have to pay a penalty. A taxpayer with a salary of more than Rs 5 lakh has to pay a fine of Rs 5000. At the same time, a fine of Rs 1,000 is imposed on those with a salary less than Rs 5 lakh.