RBI KYC Guidelines: RBI was getting a lot of complaints from people regarding KYC. Now RBI has given a big relief to the people in the new year. People no longer need to visit the bank branch to get their KYC updated. People can also update their KYC online.

If you have a bank account, then there is a need to update KYC from time to time. For this one has to go to the branch of the bank. In such a situation, many times people have to face problems in updating KYC. Now you will not have any problem in updating KYC. The Reserve Bank of India has given a gift to the people on New Year.

The Reserve Bank of India (RBI) has released an update for Fresh KYC, giving relief to the customers. Now customers can do the process of getting fresh KYC done from home through Video Based Customer Identification (V-CIP) process. RBI has issued guidelines to all banks for this. RBI has said that if there is no change in KYC, then Re-KYC can be done only by self-declaration.

For this facility, the Central Bank (RBI) has also given instructions to all the banks of the country. RBI has advised customers should also be given the option to make such self-declaration through different non-face to face channels. RBI has said that customers need not visit their bank branch to update Know Your Customer (KYC) details if they have already submitted valid documents and have not changed their address. Is.

RBI was getting complaints

RBI was continuously receiving complaints against the banks that even after submitting the documents online, the process of digital re-KYC could not be processed through the websites and mobile apps of the banks. According to RBI, the customer can complete the process of re-KYC through his registered email ID, mobile number, ATM, online banking or internet banking, mobile app or through letter. There is no need to go to the bank branch in this. If only the change of address is to be done, then the address proof can be submitted through these means and the bank will have to complete the verification process within two months.

KYC can be updated in this way

According to RBI, the customer can make video calls in banks that provide this facility. Customers can also complete a new KYC process through video call. RBI has asked customers to contact their bank for more details on the options available for updating KYC details. RBI has said that a fresh KYC process should be initiated only if the documents in bank records do not conform to the current list of ‘officially valid documents’. Fresh KYC is also required if the document submitted earlier has expired.

The customer should not insist on calling the bank

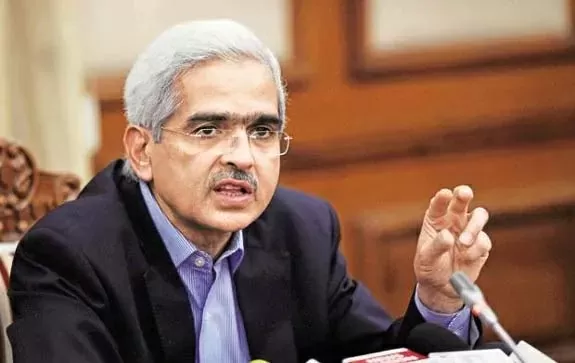

In December, RBI Governor Shaktikanta Das had clarified in a press conference that banks should not insist on the customer calling the branch. The governor’s clarification came after several customers said that their banks have asked them to come to the branch for KYC before December 31, 2022. This KYC demand had raised apprehensions that accounts could be frozen if customers did not turn up at the bank.