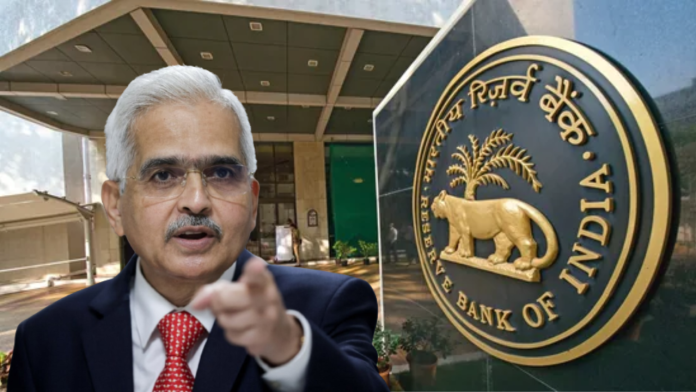

RBI penalty on Canara Bank: The Reserve Bank of India (RBI) has imposed a penalty of Rs 2.92 crore on Canara Bank for violating different rules. RBI said that this action was taken in relation to linking interest rates to external benchmarks like Repo Rate and opening of savings accounts of ineligible entities.

The central bank said in a statement that a statutory inspection was carried out on the basis of the bank’s details as on March 31, 2021. The central bank had conducted an investigation in July 2020 after receiving a complaint of major fraud from another bank.

After investigation, it was found that the bank could not link the interest on ‘floating rate’ based retail loans and loans given to MSMEs to the external benchmark. Also, during the financial year 2020-21, it could not even link the interest on the floating rate based rupee loan with its Marginal Cost of Lending Rate (MCLR).

The RBI said the bank opened several savings deposit accounts in the name of ineligible entities, entered fake mobile numbers in several credit card accounts and deposited deposits under the Daily Deposit Scheme and 24 months after account opening. Interest was not paid on premature withdrawal of Rs.

The Reserve Bank said that the bank charged the SMS service from the customers, which was not based on its actual usage. The bank also failed to do customer due diligence on transaction basis.

RBI said, after sending a notice to the bank, it was asked to show cause why the penalty should not be imposed on it. After this, RBI has taken this action after considering the written and oral reply of the bank.