Maximum Interest Rate on FD: Most of the senior citizens do not want to take any risk in terms of investment. He prefers to invest part of his savings in a better and guaranteed return scheme. At present, there are many schemes available for them. One of which is also a fixed deposit (FD) scheme.

This scheme is completely safe and returns are also guaranteed on it. Market volatility has no effect on this scheme. Senior citizens get a special discount on the interest income of FD. Under Section 80TTB of the Income Tax Act, resident senior citizens get the benefit of deduction up to Rs 50,000 on interest income on FDs in banks, co-operative banks or post offices. Also, there will be no TDS deduction from interest payment up to Rs 50,000 in a financial year.

This way you will get more returns

If you are above 60 years of age, you can go for these FDs and choose the tenure and amount based on your financial goals. Instead of putting your money in one FD, you can open multiple FD accounts of different amounts and terms. You can reinvest your money after maturity if the interest rate increases.

Compare interest rates before investing

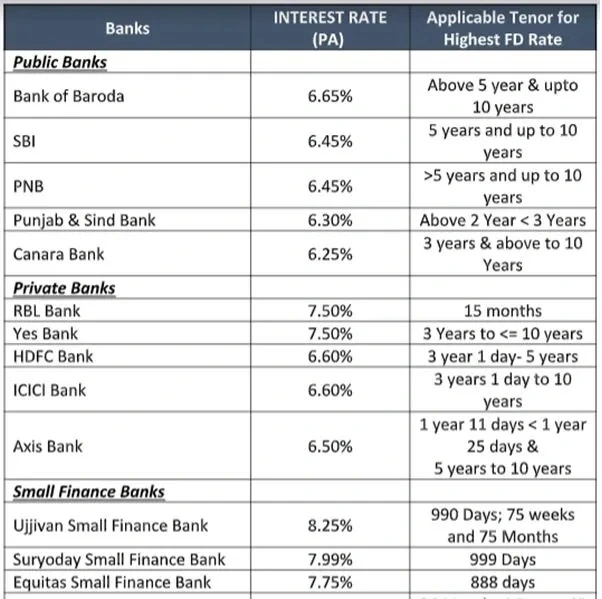

FDs are useful if you need money for emergency use. Some banks allow you to break your FD without levying any penalty or additional charges. However, you should compare the rates offered by different banks before investing in FDs. Through this you will be able to invest in the right place. Along with this, you should also read the terms and conditions related to it properly. It is easy to open your FD account.

You can visit any nearest bank branch or apply online also. It is often advised that you open your FD account with the bank where you have an existing relationship as it becomes hassle free for you. You can also avoid more paperwork processes. If you are thinking of investing in FD, then the list given below can prove to be helpful in this. The maximum interest rate and maturity period have been given in this list.