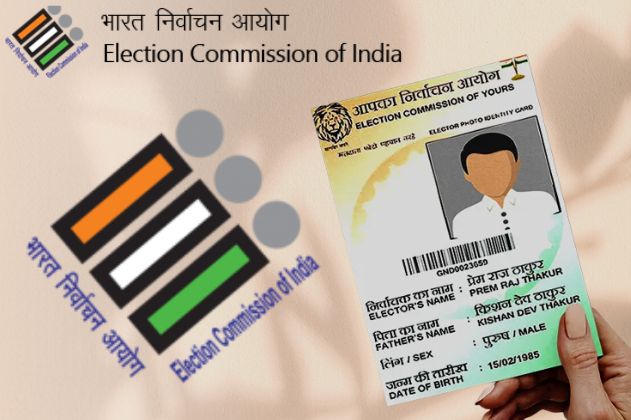

Voter ID Card: The government has extended the deadline to link Aadhaar card with voter ID. Earlier this work was to be done before April 1, 2023, but this deadline has been extended for one year. According to the government notification, now this work can be done till March 31, 2024.

There is big news for Aadhaar Card holders. Giving relief, the government has extended the deadline for linking Aadhaar and Voter ID. Earlier this work had to be done before 1 April 2023, but now you can link your Aadhaar with Voter ID till 31 March 2024.

Information issued notification

According to media report, the Ministry of Law and Justice has shared its information in a gazette notification. However, the government says that this work is not compulsory, but voluntary. According to the Election Commission, this will give information about the name of the same person appearing in more than one constituency or appearing in the same constituency more than once. This work can also be easily dealt with online by sitting at home. The process of completing it is very easy.

Link Aadhaar-Voter ID like this

- First of all go to National Voter Service Portal nvsp.in.

- Now click on Search in Electoral Roll on the home page.

- Fill all the requested information and Aadhaar number on the new page.

- After filling all the information, an OTP will come on your registered phone.

- Enter OTP at the designated place. As soon as you do this, your Aadhaar will be linked to Voter ID.

- Its information will be given on your phone through SMS or by e-mail.

Less time left to link Aadhaar-PAN even though the government has extended the date for linking Aadhaar card with Voter ID. But the deadline for linking Aadhaar-Pan is approaching. Only 9 days are left to complete this work. If this work is not done by March 31, 2023, then your PAN card will be deactivated. That means it cannot be used.

If this happens, card holders will not be able to do things like opening mutual funds, stocks and bank accounts. Apart from this, if the closed PAN is used as a document, then there is a provision of fine up to Rs 10,000 under Section 272B of the Income Tax Act.

How to link PAN with Aadhaar

- Log in to the official website of Income Tax www.incometax.gov.in.

- Go to the Quick Links section and click on Link Aadhaar.

- A new window will open on your screen.

- Fill your PAN number, Aadhaar number and mobile number here.

- Select the option ‘I validate my Aadhaar details’.

- OTP will be received on your registered mobile number. Fill it and then click on ‘Validate’.

- After paying the fine, your PAN will be linked to Aadhaar.