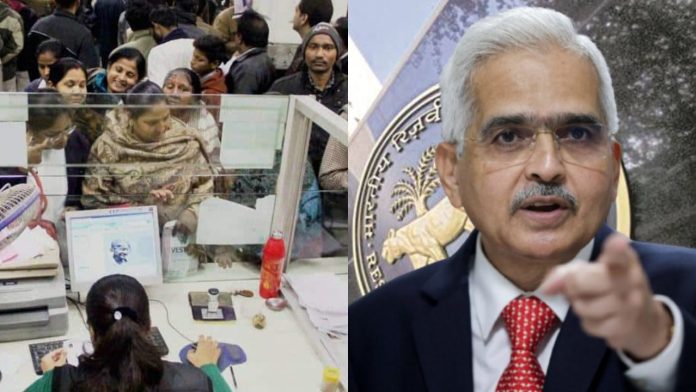

The Reserve Bank of India (RBI) in its monthly bulletin released on Tuesday said that banks may once again raise interest rates to increase the deposit base among banks.

Competition among banks to increase interest rates has also increased. After the increase in the repo rate of the central bank RBI by 250 basis points (BPS) in May 2022, there has been a competition among the banks to increase the interest rates.

Interest rates may increase once again in April

Even after the inflation in the US banking system is low, analysts believe that RBI can increase the repo rate by 25 bps i.e. 0.25 percent in April. The repo rate could be 6.75% in the next month. After an increase of 0.25 percent, it can be 2.75 percent.

Increased investment in FD

RBI has said in its bulletin that FD returns have improved. Due to this, deposits in banks have increased. There has been an increase of 13.2 percent in deposits in FDs on an annual year on year basis. Whereas, there has been an increase of 4.6 percent and 7.3 percent in the current and savings accounts respectively. However, it was also said that the input cost has also increased due to increase in inflation.

Now this is the average interest

After increasing the RBI’s repo rate for six consecutive times, banks have increased the interest rates on all investments i.e. FDs. Small finance banks are offering attractive interest rates as compared to public sector banks. According to data from BankBazaar, the average interest rate of top 10 banks on FDs maturing in 3 years is 7.5%.