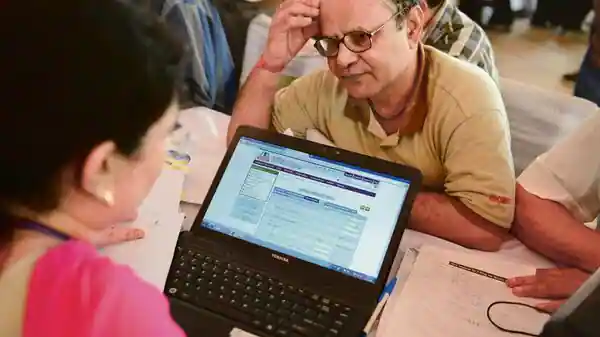

ITR Filing 2023: There is very important news for tax payers. The last date for filing Income Tax Return (ITR) has been fixed by the Finance Ministry .

Now you have to file your ITR by 31st July. If you do not do this, then you can also get into trouble. This time, along with legal action against those who do not file ITR, the government has also made a provision to increase the amount of fine.

Last date will not be extended further

The government said that this time the last date for filing Income Tax Return (ITR) will not be extended further. Because of which it is necessary for all tax payers to file their ITR before the last date. Taxpayers who do not file ITR will also not be able to carry forward the losses of the current financial year. Apart from this, if you file your ITR later, then you will also have to pay a hefty penalty on it.

That’s why it is necessary to file ITR

According to experts, if a person has regular income. Also, if he comes in the tax slab set by the government, then he is required to file income tax return. If he does not do this, then he can also be blacklisted by the department. Apart from this, if this happens, he will not be offered loan from any bank. Along with this, legal action can also be taken against you on the matter of tax evasion.

Works like documents too

ITR filing also serves as a document. You can use it as a proof in different financial applications. Many times, while applying for a loan, bankers ask for a copy of ITR for verification. This also shows your regular income. Apart from this, ITR also helps you in credit card, insurance policy and other such important work.