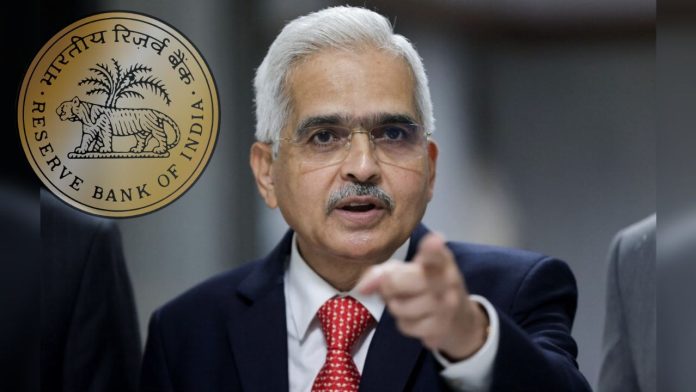

Many states in the country are preparing to implement the old pension scheme one after the other. Some states have already implemented it. But on Monday, the RBI warned the state governments on returning to the pension scheme.

RBI said that if the states implement the old pension scheme, then there is a big threat to their financial management. The RBI has issued an annual report on the finances of the states, in which the financial condition of the states after the Corona epidemic has been described as very promising but has expressed concern about the old pension scheme.

This statement of RBI has come at a time when some state governments are restoring the old pension scheme. Earlier this month, Himachal Pradesh became the fourth state to go back to OPS for state government employees. Chhattisgarh, Rajasthan and Punjab have also started OPS.

RBI said this in the report In its latest report on State Finance, RBI said about the old pension scheme, ‘The annual savings in fiscal resources that this move entails is short-lived. By postponing current spending to the future, states are running the risk of unfunded pension liabilities in the coming years.

States may face trouble

RBI has called it a big threat to the sub-national fiscal horizon. At the same time, RBI has called for higher capital expenditure on health, education, infra and green energy from the states. In the report, the RBI said that off-budget borrowing, along with improving the fiscal position in states, is an issue that the Union finance ministry took up with state governments. RBI has suggested that states should focus on higher capital expenditure.

States will not be able to bear the financial burden of OPS In November, former chairman of NITI Aayog Arvind Panagariya had also said that states will not be able to bear the financial burden of OPS. According to the report of Indian Express, he said that no state can do this because the liability will be huge.

For this reason, the demand for old pension by the employees is actually, after the implementation of the New Pension Scheme in January 2004, the OPS was abolished. Under the old pension scheme, when the employee retired, he was paid 50 percent of the last salary as pension. On the other hand, in the Old Pension Scheme, there was no effect of the service period of the employee.

Apart from this, along with the increase in dearness allowance every year, there was an increase in the salary when the pay scale was implemented. After the death of the OPS holder, the wife or other dependent got the pension. Due to these reasons, the employees are demanding re-implementation of the Old Pension Scheme. Some state governments have announced to implement OPS again.