Post Office scheme: Post office schemes are long term investments. These schemes are for those who prefer traditional investments and have a long-term outlook. Let us know about the wonderful scheme of the post office.

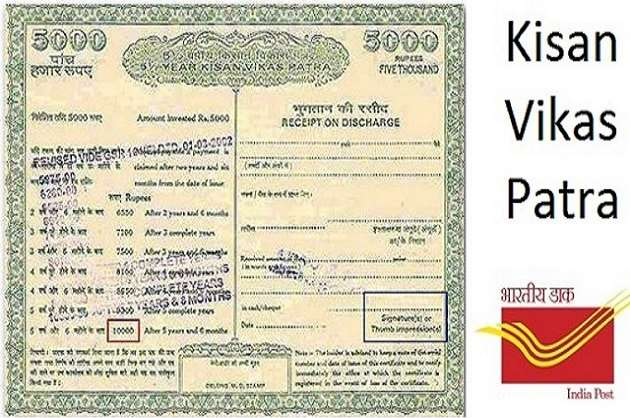

With safe investment, you can secure the future of yourself and your family. At present, according to the risk capacity, you have many types of investment options available. If you have a high risk appetite, then you invest in equities, such as mutual funds. If you want a safe and zero risk investment then Post Office Saving Schemes (Kisan Vikas Patra) can be a better option.

Post office is a long term investment

Post office schemes are long term investments. Actually, these schemes are for those who prefer traditional investments and make long term investments. Government guarantee is available on post office schemes, that is, there is absolutely no risk in it. Also a guaranteed return on investment is also available. Here we are going to tell you about a similar post office scheme named Kisan Vikas Patra.

What is Kisan Vikas Patra Scheme (KVP)

The duration of this scheme is 124 months i.e. 10 years 4 months. If you have invested in this scheme from 1st April 2022 to 30th June 2022, then the lump sum amount deposited by you doubles in 10 years and 4 months.

How much to invest?

There is no maximum investment limit in this scheme. You can buy Kisan Vikas Patra Certificate with a minimum investment of Rs 1,000, that is, you can put as much money as you want in this scheme. This scheme was started in 1988, then its objective was to double the investment of farmers, but now it has been opened to all.

required documents

With no limit on this investment, there is a risk of money laundering. Therefore, in 2014, the government made PAN card mandatory for investments above Rs 50,000.

If investing 10 lakhs or more, then income proof will also have to be submitted, such as ITR, salary slip and bank statement etc.

Apart from this, Aadhaar is also to be given as an identity card.

How can I buy?

1. Single Holder Type Certificate: This type of certificate is purchased for self or for a minor

2. Joint A Account Certificate: It is issued jointly to two adults. Payment is made to both the holders, or whoever is alive.

3. Joint B Account Certificate: It is issued jointly to two adults. pays to either one or the one who is alive

Features of Kisan Vikas Patra

1. Guaranteed returns are available on this scheme, it has nothing to do with market fluctuations, so it is a very safe way of investment. After the end of the period, you get the full amount

2. There is no tax exemption under section 80C of Income Tax. The return on this is fully taxable. There is no tax on withdrawal after maturity

3. You can withdraw the amount after maturity i.e. 124 months, but its lock-in period is 30 months. Before this, you cannot withdraw money from the scheme, unless the account holder dies or there is a court order

4. Investment can be made in it in denominations of 1000, 5000, 10000, 50000.

5. You can also take loan by keeping Kisan Vikas Patra as collateral or as security.