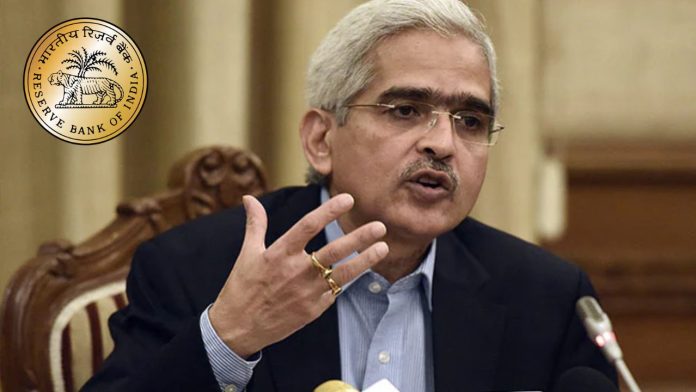

Reserve Bank of India: A committee constituted by the Reserve Bank of India (RBI) has suggested banks to take some steps in the interest of the customers.

The committee has suggested banks to show online settlement of claims after the death of account holder’s heirs and flexibility in submission of life certificate on behalf of pensioners.

Banned due to non-compliance of KYC

The report of the committee constituted to review customer service standards in RBI-regulated financial institutions also suggested that non-updation of Know Your Customer (KYC) from time to time hampers operations of accounts. But don’t be banned.

Report released by the committee The committee

said in its report released on Monday that there should be a time limit for returning the property documents to the borrowers after the loan account is closed and the lender should be fined for not giving this time.

In case of loss of property documents, banks and financial institutions should not only help in getting certified registered copies of the documents at their own cost, but also adequately compensate the customer, according to the RBI deputy governor’s report . .

The Reserve Bank had constituted this committee in May last year under the chairmanship of BP Kanungo, former deputy governor of RBI. The committee has given its recommendations after reviewing the complaints filed under the Internal Grievance Redressal (IGR) system of financial institutions.

These suggestions given for the pensioners

The committee has also given some suggestions for the benefit of the pensioners. Accordingly, pensioners should be able to submit their life certificate at any branch of their bank. Also, they should be allowed to deposit LCs in any month of their choice to avoid rush.