RBI rules related to bank lockers: Most of the banks in the country provide locker facilities. Keeping jewelry and cash in the locker becomes tension free. But, what if termites lick your money kept in the locker. Recently, a similar incident had happened in Udaipur, Rajasthan.

Two lakh rupees of the customer were kept in the locker of Punjab National Bank. When he reached to withdraw his money, the notes were licked by termites. In such a situation, the question arises that if something untoward happens with your money kept in the locker, then someone is responsible for it. The answer to all these incidents is the new locker rules, which have come into force from February 1, 2023.

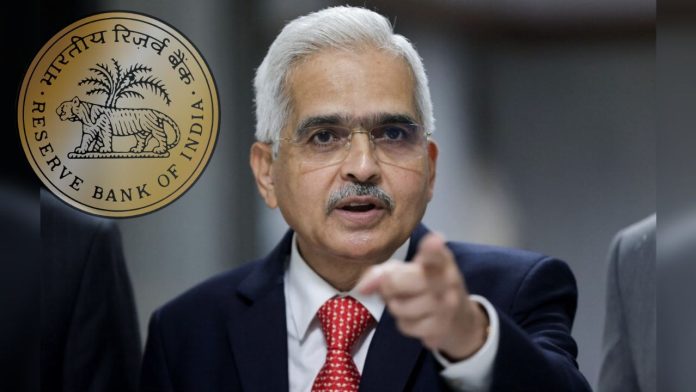

These are the new rules of Reserve Bank of India

According to the new locker rules of the Reserve Bank of India, if any item kept in the locker is damaged due to the negligence of the bank, then it will be the responsibility of the bank. It is the responsibility of the Bank to take necessary steps for the security of the premises. If the goods kept in the locker are damaged due to the negligence of the bank, then the bank will have to pay compensation. This compensation will be 100 times the rent of the locker for one year. During the loss, the banks cannot say that they do not have any responsibility.

Compensation will not be given in these cases

Bank will not be responsible if the locker is damaged due to natural calamity like earthquake, flood, storm etc. Apart from this, the bank will not be responsible even if the cash etc. kept in the locker of the bank is damaged due to the customer’s own fault. However, if there is a fire or theft due to the negligence of the bank, then the bank will be responsible for it. Apart from this, if any employee of the bank embezzles money or commits fraud, then also the bank will be responsible.

Let us tell you that the Reserve Bank of India had advised all the banks to renew the locker agreement of the existing customers of the banks from January 1. Along with this, the bank was asked to ensure that there should not be any unfair condition or terms in the agreement.