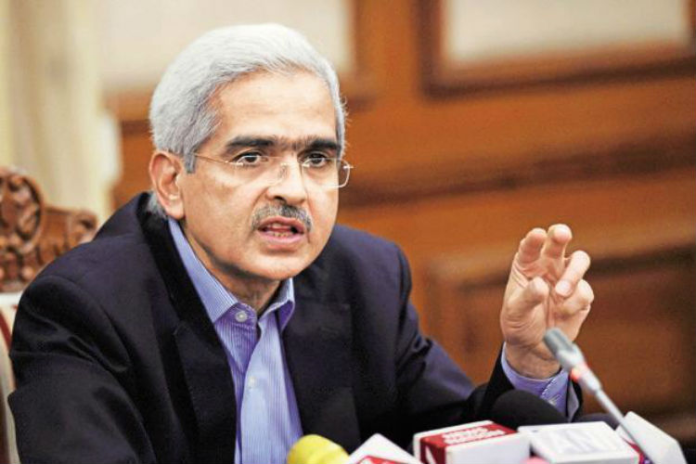

Reserve Bank Of India Repo Rate: The Reserve Bank of India has not increased the repo rate this time and has given relief to the people.. RBI Governor Shaktikanta Das (RBI Governor) Shaktikant Das) said that no decision has been taken to increase the repo rate.

Although the global conditions are challenging and due to its effect, the Indian conditions have also been seen. The Monetary Policy Committee of RBI has taken this decision with majority.

What is RBI’s forecast for growth?

For the financial year 2024, RBI has increased it from 6.4 percent to 6.5 percent without increasing the economic growth rate. In this way, RBI is confident of a slight increase in growth.

What did the RBI governor say on inflation

The RBI governor said that “there are still many challenges before the country’s central bank on the inflation front and our work is not over yet. Till the time the inflation rate comes close to or under the target set by the RBI, we will have to continuously Gotta work.”

Repo rate will remain at 6.5 percent

Under the monetary policy before the financial year 2023-24, Governor Shaktikanta Das has informed about not increasing the repo rate. Now the RBI repo rate will remain at 6.50 percent. The government last increased the repo rate for the financial year 2022-23 on February 8, 2023.