Reserve Bank of India: If you too often pay through Unified Payments Interface (UPI) in the market or elsewhere, then this news will make you happy.

According to the recent decision taken by the Reserve Bank of India (RBI), there will be no fee on UPI for transactions up to Rs 2,000 on the use of Rupay Credit Card. Instructions have been given in this regard in the recently issued circular by RBI.

Let us tell you that the order of the circular came into effect from October 4,

Rupay credit card is in circulation for the last four years. All the major banks of the country are connected to it. RBI’s circular issued on Tuesday (October 4) said, ‘The process of linking the credit card on the app and generating the UPI PIN requires the consent of the customer to enable the credit card in all types of transactions.’

2,000 or less, NPCI said the existing process of the app for international transactions would be applicable to credit cards as well. It also said that zero merchant concessional rate (MDR) will be applicable for this category up to transaction amount of Rs 2,000 or less.

In the information given by RBI, it was said that this circular will be applicable from the date of issue. That is, this rule has come into effect from 4 October. RBI also said that members are requested to take note of this and bring the contents of this circular to the notice of the concerned stakeholders.

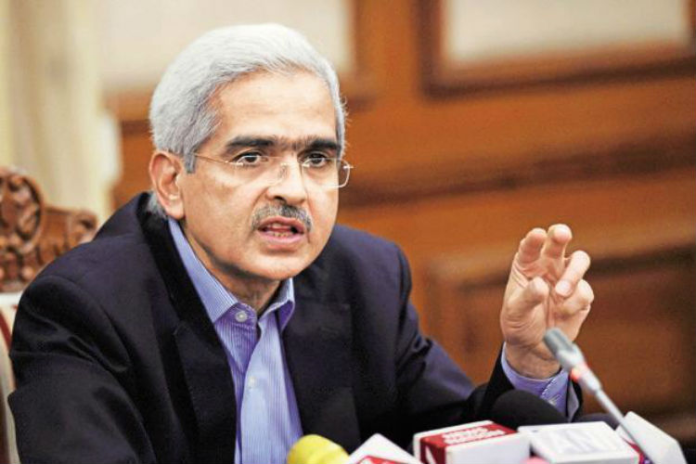

RBI Deputy Governor T Ravi Shankar had earlier said, “The purpose of linking credit cards with UPI is to provide a wider choice of payment options to the customer. Presently UPI is linked to savings accounts or current accounts through debit cards.